Depreciation Made Simple for Physician Real-Estate Owners

Oct 17, 2025

Today’s Micro-Business Tactic: Understanding Real Estate Depreciation Like a Physician-Entrepreneur

If you own rental real estate—whether it’s a short-term rental, medical office building, or syndication fund—you already enjoy cash flow, appreciation, and leverage. But one of the most powerful (and misunderstood) benefits is depreciation—a non-cash expense that can dramatically reduce your taxable income while your bank balance keeps growing.

1. The Big Idea: Paper Losses, Real Gains

Depreciation acknowledges that physical assets wear down over time. The IRS lets you deduct a fraction of a property’s value each year to represent this “wear and tear.” For residential property, the IRS assumes a 27.5-year useful life; for commercial property, it’s 39 years.

Example: If you buy a $1.1 million four-plex and allocate $900,000 of that to the building (excluding land), your straight-line annual depreciation is about $32,700 per year ($900,000 ÷ 27.5). That means you can earn rental income, deduct $32K on paper, and keep your real cash flow nearly untouched.

2. Cost Segregation & Bonus Depreciation: The Turbo Button

Depreciation gets even better when you break down a building into its components: walls, wiring, flooring, cabinets, appliances, parking lots, landscaping. A cost-segregation study—often performed by an engineering firm—identifies shorter-life assets that can be depreciated over 5, 7, or 15 years instead of 27.5 or 39.

Read More: The Physician’s Guide to Cost Segregation Studies

When combined with bonus depreciation, these shorter-life components can be expensed immediately in year 1 (subject to current IRS phase-in rules).

Example:

-

You buy a $2 million property (land excluded).

-

A cost-segregation study finds $600,000 in 5- to 15-year property.

-

If 100% bonus depreciation is available, you could deduct the entire $600,000 that first year.

That means a physician earning $400K in W-2 income could invest passively in a real-estate fund, receive strong cash flow, and report a large paper loss on the K-1—all without touching a stethoscope.

3. Why This Matters to Physicians

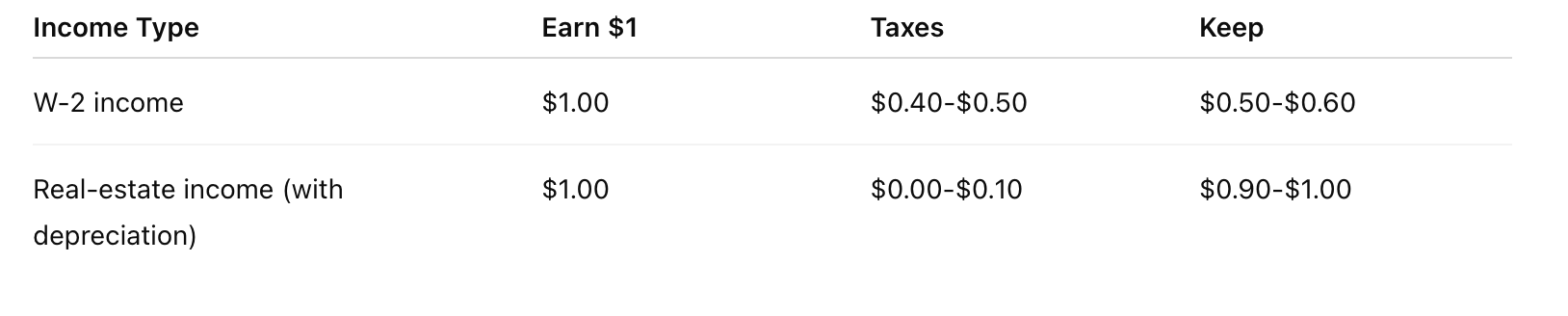

Let’s compare the tax efficiency of a dollar:

The difference? Depreciation deductions. They turn taxable rental income into largely tax-sheltered income, letting your micro-business compound your earnings faster.

4. Real Estate Professional Status (REPS): The Holy Grail

If you or your spouse qualify as a Real Estate Professional under IRS rules (material participation + 750 hours/year or the STR loophole of 100 hours), you may be able to offset active income—like your 1099 or W-2 physician pay—with these paper losses. Most full-time clinicians don’t qualify, but some physician-spouses or semi-retired doctors do.

Even if you don’t, unused losses carry forward and can offset future passive income or be realized on sale.

5. Depreciation Recapture—The Catch to Plan For

When you sell, the IRS “recaptures” some of those depreciation deductions at up to 25% rates. Smart investors plan for this with:

-

1031 exchanges to defer taxes.

-

Refinancing to pull out equity tax-free.

-

Long-term holds that stretch deferral for decades.

Depreciation isn’t about avoiding taxes forever—it’s about timing them wisely so your dollars grow and work harder in the meantime.

6. Physician-Sized Example

You invest $100,000 in a passive real-estate fund. During the year you receive $8,000 in cash distributions, but your K-1 shows a $25,000 paper loss due to cost segregation and bonus depreciation. You made money, but for tax purposes, you lost money. Those suspended losses can offset future passive income or capital gains when the property sells.

7. Tactical Next Steps

-

Ask your CPA if your current properties have been cost-segregated.

-

Model your tax benefits with a depreciation calculator (see Tool of the Week below).

-

Consider professional guidance before the year ends—timing can dramatically impact your 2025 tax position.

-

Read up on Real Estate Professional Status and cost-seg studies

Lessons from the Field

“One of my coaching clients, a hospitalist, bought a $750K duplex through his micro-corporation and claimed $180K in bonus depreciation year one. That single strategy saved him nearly $60,000 in federal taxes—without lifting a hammer.”

Tool of the Week

Tool of the Week: “The Physician’s Guide to Passive Real-Estate Investing” → Go deeper to learn why real estate is a great way to diversify your income as a doctor.

🚀 Scale with Coaching

Want personal guidance? Our 1:1 coaching and consultations help you execute faster and smarter.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.