Expanded SALT in 2026 and What It Really Means for Your Micro-Business

Feb 13, 2026

Today’s Micro-Business Tactic

Expanded SALT in 2026

I keep seeing the same reaction from physicians when the SALT headlines started circulating again.

“Finally, they fixed the SALT cap.”

That belief is understandable. It is also incomplete.

The SALT deduction did expand in 2026. But the benefit is narrow, conditional, and heavily dependent on how you earn your income and how your business is structured.

If you run a professional micro-business or are moving toward one, this matters more than most people realize.

Why SALT Matters More Once You Think Like an Owner

When you are a W-2 employee, SALT feels abstract. It is just another line item your CPA talks about once a year.

When you own a business, SALT becomes part of your planning framework.

State income tax Local income tax Property tax

These costs do not just affect your personal return. They affect how you structure income, where income lands, and whether deductions actually help you.

That is where the 2026 expansion creates confusion.

What Actually Changed in 2026

Here is the clean explanation without political noise.

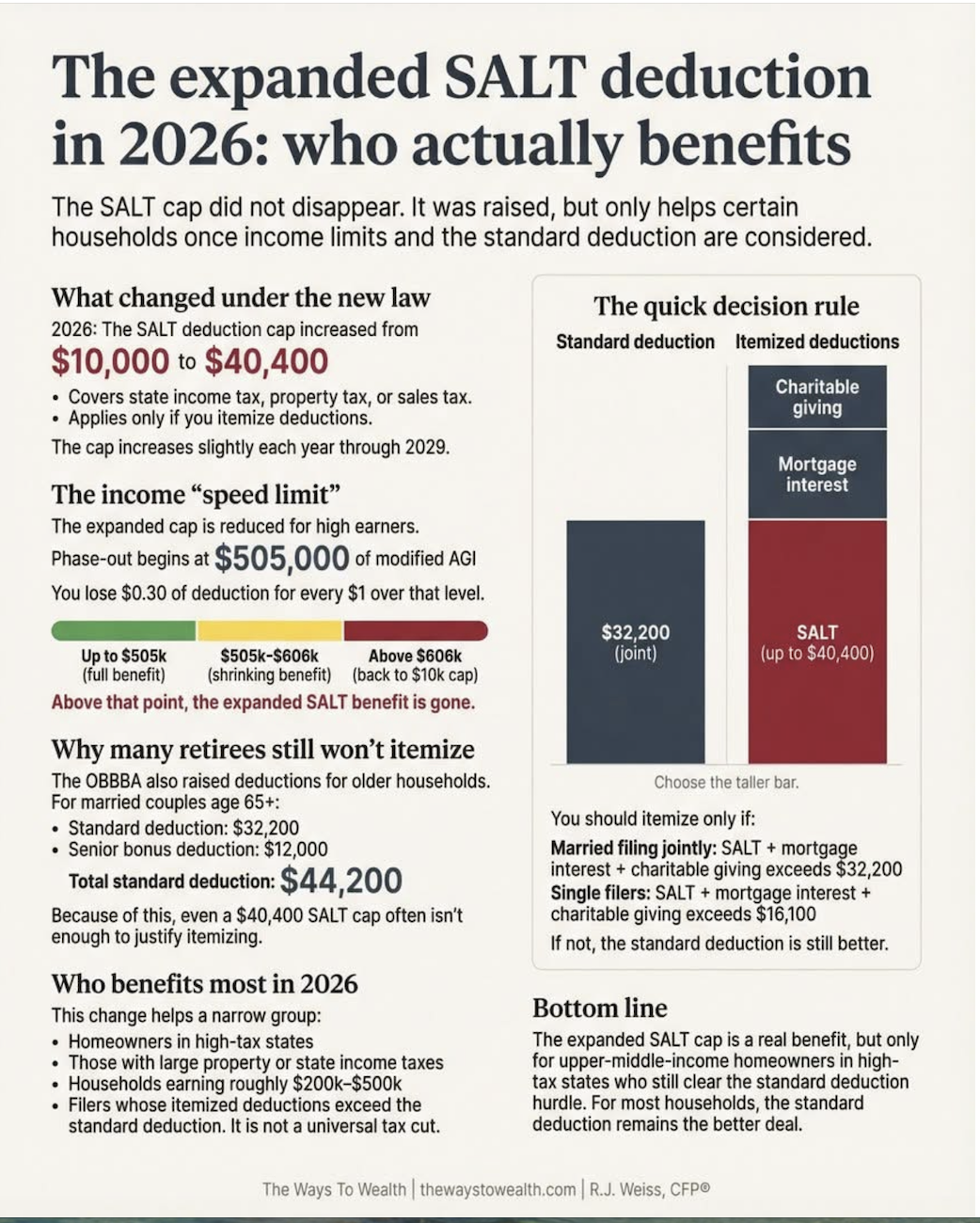

The SALT deduction cap increased from $10,000 to $40,400 starting in 2026. The cap increases slightly each year through 2029. SALT still only helps if you itemize deductions.

Nothing about that guarantees a tax win.

The Income Speed Limit Nobody Talks About

The expanded SALT deduction phases out as your income rises.

The phaseout begins at roughly $505,000 of modified adjusted gross income. For every dollar above that level, you lose $0.30 of the expanded deduction. By the time your income moves past the low $600,000 range, the benefit is gone and you are effectively back at the old $10,000 cap.

This is where many high earning physicians misunderstand the headlines.

The expansion exists, but it is not designed for top tier earners with large W-2 incomes or poorly structured 1099 income.

Why the Standard Deduction Still Wins for Many Physicians

Another detail that gets missed.

The standard deduction also increased.

For married couples filing jointly over age 65, the total standard deduction can exceed $44,000 once the senior bonus is included.

That means many physicians will not itemize even with a $40,400 SALT cap.

If your SALT, mortgage interest, and charitable giving do not clear that bar, itemizing still does not make sense.

Expanded SALT does not override basic math.

Lessons from the Field

This week, one of my coaching clients, Dr. Carter, assumed the expanded SALT deduction would reduce her tax bill by tens of thousands.

After we walked through her numbers, the outcome surprised her.

She earned too much to keep the expanded deduction. Her standard deduction was still higher than itemized. The SALT change had no meaningful effect on her taxes.

What did matter was how her income flowed through her professional entity.

That is where physicians either win or quietly leak money.

Where Micro-Business Owners Still Have an Advantage

Here is the part that matters for clinician entrepreneurs.

SALT is a personal deduction. Business expenses are not SALT.

When you operate through a properly structured micro-business, many costs that would otherwise fall under SALT can shift into ordinary business deductions.

Office expenses, Professional software, Education, Consulting, Travel, and Portions of home costs when appropriate.

These deductions bypass SALT entirely.

That distinction is why two physicians with the same gross income can end the year in very different financial positions.

The Real Strategy Behind SALT Awareness

SALT is not something you chase.

It is something you account for.

If your entire tax plan depends on itemized deductions saving you, you are already boxed in.

Owners focus on where income lands first, not which deductions survive phaseouts later.

This is a theme I have written about repeatedly on The Independent Physician blog, especially around why professional autonomy and entity structure matter more than marginal tax tweaks.

If you want context on why doctors who control their business structure tend to retain more income over time, explore the related essays here: Case Studies On How Incorporation Can Cut Your Taxes In Half

Case Study

Dr. Carter, Hospital Employed to Hybrid Owner

Dr. Carter practiced full-time under a W-2 model for years. Her taxes felt high but unavoidable.

Once she began shifting part of her income into a professional entity, the conversation changed.

The SALT expansion did not move the needle for her. Business deductions did. Income placement did. Timing did.

The win was not a new law. The win was ownership.

Tool of the Week

Physician Tax Strategy Guide

This downloadable guide helps you identify which deductions belong at the business level versus the personal level, so you are not relying on fragile itemized deductions.

“This tool helps you execute today’s strategy in about 10 minutes.”

Download the Tool → Tax Deduction Guide for Micro-Business Owners

If you are early in your ownership journey, pair this with one of the free PEA ebooks focused on transitioning from employee thinking to owner thinking. Those are designed to help you see these issues before tax season, not after.

Scale with Coaching

Want personal guidance?

Our 1:1 strategy sessions help you structure income, expenses, and ownership decisions with clarity instead of guesswork.

Book a Strategy Consultation Session →

If you want ongoing support as you build and refine your micro-business:

Get Started With 1:1 Business Coaching Today →

Final Thought

Expanded SALT in 2026 is real.

The benefit is also limited.

Owners do not wait for tax law changes to save them. They design systems that work regardless of headlines.

That shift in thinking is the difference between reacting every April and planning every January.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.