How Your Business Entity Determines Your Retirement Ceiling (and Why Most Clinicians Get This Wrong)

Dec 05, 2025

How Your Business Entity Determines Your Retirement Ceiling (and Why Most Clinicians Get This Wrong)

Today’s Micro-Business Tactic:

If you’re earning 1099 income, even just a small amount, your business entity quietly controls the upper limit of how much you can shelter in tax-advantaged retirement vehicles.

Most physicians think:

“I’ll just open a Solo 401(k) and max it out.”

But as you grow your micro-business, especially once you cross $200K+ of 1099 income, you’ll hit the ceiling much faster—or much later—depending entirely on your entity choice.

And the truth is stark:

The same physician, earning the same money, doing the same clinical work can save 2–3× more for retirement—just by changing their entity structure.

Today’s business tactic is one of the most overlooked advantages of becoming a micro-business owner. Once you understand how the IRS defines “compensation,” how Cash Balance Plans actually work, and how entity structure shapes both inputs, you begin to see why:

Self-employment is not just a tax structure—it’s a wealth-building strategy.

Let’s break down why the structure matters, what the IRS rewards, and how you can optimize your own plan.

Why Your Entity Structure Is the Hidden Lever Behind Retirement Funding

Physicians routinely leave tens of thousands, often hundreds of thousands, of dollars on the table simply because they haven’t chosen the right business entity for their 1099 income.

Your entity structure defines your compensation.

Your compensation determines your retirement contribution limits.

And retirement contributions are one of the greatest tax shelters available to physician-entrepreneurs.

Here’s the key takeaway straight from your uploaded comparison guide:

“S-Corp physician-owners routinely achieve 2–3× the combined contributions compared to sole proprietors with identical revenue.”

Let me show you why.

Entity Structure Determines How the IRS Defines ‘Compensation’

The IRS doesn’t treat all income the same. For retirement plan calculations, “compensation” is the most important number, and your entity structure defines it:

1. Sole Proprietor (Schedule C)

-

Compensation = “net earnings” after self employment tax adjustments

-

IRS forces you to reduce your compensation to 92.35%

-

Then subtract half of your self-employment tax

-

Reduced compensation limits your contributions

Bottom line: your compensation number shrinks before you even start calculating contributions.

This means your maximum allowable contributions shrink with it.

2. S-Corp (PC/PLLC taxed as S-Corp)

-

Compensation = W-2 salary you get to choose

-

Remaining profit paid as distributions (FICA-free)

-

Clean number for Solo 401(k) employer contributions

-

Stable W-2 makes actuaries love you for Cash Balance Plans

Bottom line: S-Corp owners engineer their compensation to maximize the retirement contribution formulas.

3. C-Corp

-

Also uses W-2 wages

-

Allows employer-funded benefits

-

Less flexible than S-Corp for most micro-business physicians

Bottom line: similar Cash Balance Plan performance, but double-taxation and administrative constraints make it less common.

The IRS Formulas Are the Same—But the Inputs Change Everything

This is the subtle—but powerful—truth physicians rarely understand:

The IRS contribution limits don’t change across entities. What changes is the number the formulas get applied to.

And because compensation is radically different in a sole proprietorship vs an S-Corp, your potential contributions diverge dramatically.

The Real-World Numbers (This Is Where It Gets Big)

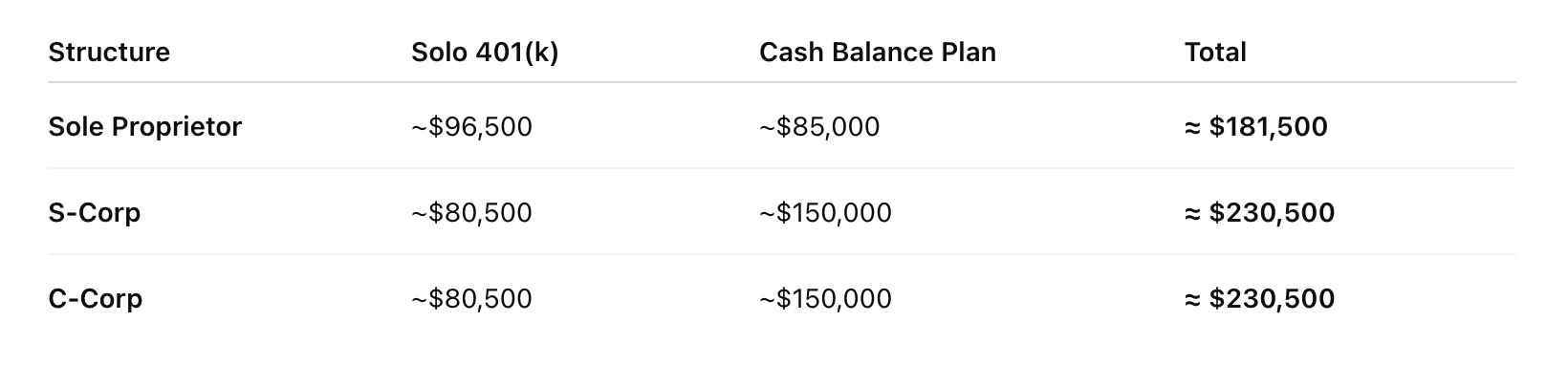

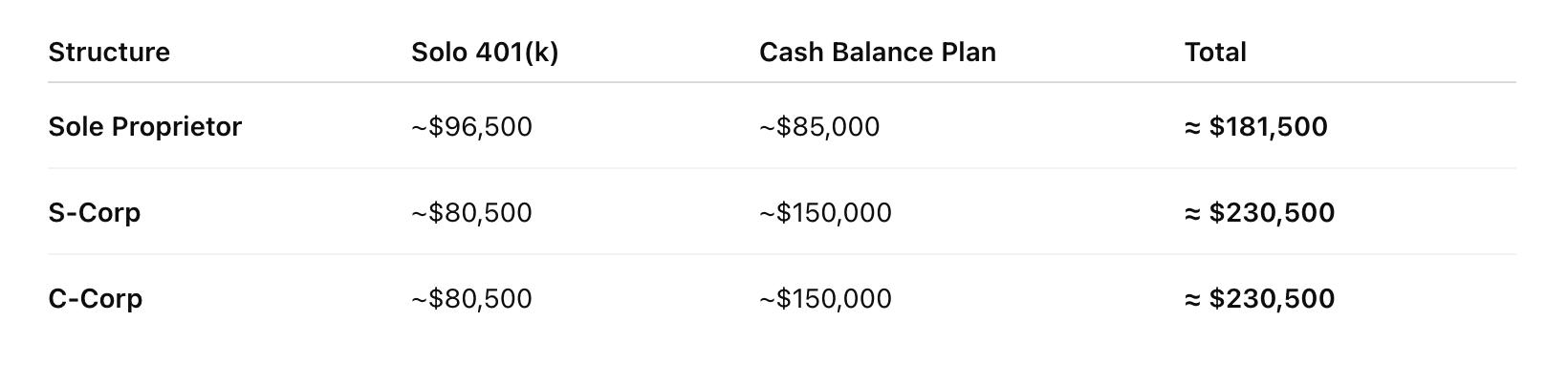

Let’s use the uploaded example for a physician earning $400,000 of 1099 income.

Here’s how the maximum retirement contribution varies:

Difference: The S-Corp structure adds roughly $50,000 more per year to your tax-advantaged retirement capacity.

Even though the Solo 401(k) piece appears smaller, the Cash Balance Plan is where the real leverage happens, and actuaries can push CBP funding dramatically higher when your W-2 is predictable.

Case Study: “Dr. L, The 1099 Hospitalist Who Unlocked $230,000 a Year in Retirement Contributions”

A hospitalist I worked with, let’s call him Dr. L, earned about $380,000 per year in 1099 income.

He had been a sole proprietor for eight years. When he came to PEA-SimpliMD for business coaching, he was proud of “maxing out” his Solo 401(k) at around $90,000 per year.

But here’s what he discovered:

-

His “compensation” was being reduced by self employment-tax math

-

His CBP actuary could never push past the lower contribution band

-

He was losing about $40,000–$60,000 per year in missed retirement opportunity

We restructured him into a Professional Corporation taxed as an S-Corp.

He set his W-2 at $210,000, took the rest as FICA-free distributions, and opened a Cash Balance Plan.

That year, he contributed nearly $230,000. The following year, almost $250,000.

That single restructuring allowed him to shelter over $500,000 in two years.

His comment to me was:

“Tod, I didn’t need an MBA. I needed a micro-business strategy.”

Why This Matters for Every 1099 Physician

Whether you’re a small-scale moonlighter making $50K of 1099 income, a hybrid physician stacking multiple revenue streams, or a full-time independent contractor, your entity structure determines:

-

How much FICA you pay

-

How the IRS defines your compensation

-

Whether your actuary can maximize CBP contributions

-

How predictable your retirement plan funding will be

-

How much tax you save annually

-

How fast your net worth compounds

And this isn’t theory, this is mechanical, mathematical reality.

This is the exact path that I took. My only frustration: I wish I had known about this earlier in my career!

As the graphic comparison notes:

“Corporate structures create more flexibility, control, and funding predictability, allowing higher allowable contributions in practice.”

Lessons From the Field

“This week a client realized she had been missing out on nearly $60,000 a year in retirement funding simply because she remained a sole proprietor. Once we restructured her as an S-Corp, her actuary immediately doubled her CBP eligibility.”

Another coaching client told me:

“I thought working 1099 made retirement harder. You showed me it actually makes retirement easier—I just needed a micro-business structure.”

And one of my favorite quotes, from a classic business thinker:

“Structure determines performance.” — Peter Drucker

Nothing could be truer in physician entrepreneurship.

Tool of the Week:

The Retirement Structure Maximizer

👉 Download Now → 7 Ways a Professional Micro-Corporation Helps Physician's FIRE

This week’s topic also pairs perfectly with your free PEA-SimpliMD e-book:

Free Digital Book: my best-selling “Doctor Incorporated: Stop The Insanity of Traditional Employment”

This free guide walks you through why micro-business structures unlock financial freedom and retirement velocity.

Scale with Coaching

If you want help designing your revenue model, optimizing your micro-business structure, and building a retirement strategy tailored to your income:

Book a Strategy Consultation Session

👉 https://www.simplimd.com/500-business-strategy

Or step directly into deeper, ongoing support:

Get Started With 1:1 Business Coaching Today

👉 https://www.simplimd.com/$2000-pea-business-coaching

Many physicians recover the cost of coaching in one tax year just by restructuring their micro-business correctly.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.