The Waterfall of Tax-Efficient Investing for Doctors

Jun 04, 2025

You’ve Worked Hard—Now Make Your Money Work Harder

As physicians, we spend decades building clinical skills, often at the expense of financial mastery. Yet the true turning point in your journey toward freedom—financially and professionally—begins when you start thinking like a business owner. You realize that growing wealth is not just about income—it’s about strategic retention, compounding, and minimizing taxes.

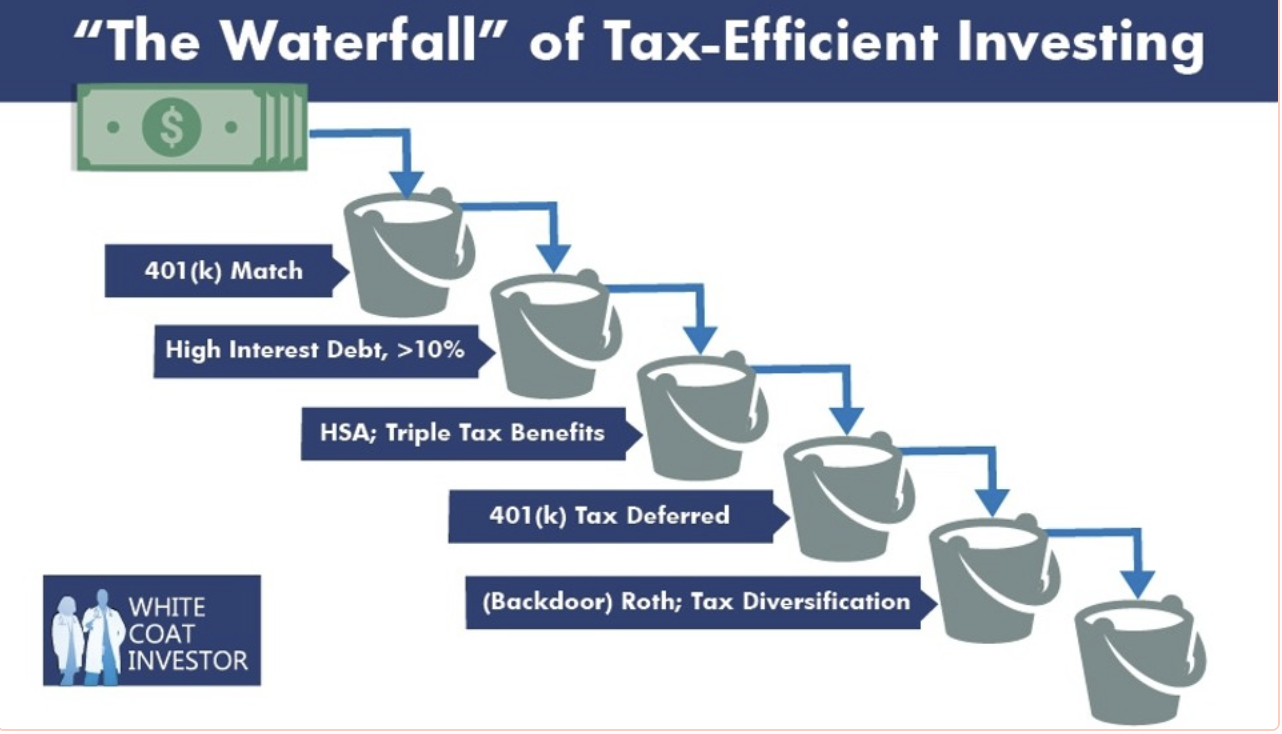

This mindset is especially critical when it comes to investing with tax efficiency. Imagine your investments as water flowing through a multi-tiered waterfall—each tier representing a different type of account or asset, with each level carefully designed to maximize tax advantages and build wealth with intention.

Let’s walk through this “tax waterfall” mindset and how you can apply it today to take back control.

Step 1: Capture Your 401(k) Employer Match (Free Money)

Your very first drop in the waterfall? Matching funds from your employer’s 401(k) plan. If they match up to 5%, and you’re only contributing 3%, you’re leaving free money on the table.

Why it matters: This is an immediate 100% return on your contributions. There’s no better first investment step—especially if you’re still partially employed while building your micro-business.

💡 Want to learn how to structure your income for optimal tax retention?

Download our free e-book: “Retain More, Grow More” →

Step 2: Eliminate High-Interest Debt

Debt with an interest rate over 10% is a guaranteed loss. Before diving into fancier investments, knock out credit cards and personal loans.

Think of it this way: Paying off a 15% credit card is like earning a 15% return—tax-free and risk-free. That’s smarter than chasing volatile returns.

Step 3: Max Out Your Health Savings Account (HSA)

If you’re enrolled in a high-deductible health plan, you have access to the most tax-advantaged account in the U.S.—the HSA. It’s triple tax-free: deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses.

💼 Download our PEA Guide for Health Insurance, HSA’s, HRA’s for Independent Physicians

Owner insight: Treat your HSA like a stealth retirement account. Let it grow untouched and reimburse yourself years later with documentation.

Step 4: Fill Your Tax-Deferred Retirement Bucket

After the match, focus on maxing out your traditional 401(k), solo 401(k), or defined benefit plan. As a micro-corporation owner, you may have multiple options for shielding income from taxes.

Real-life case: Dr. Chen, a primary care physician who transitioned to telehealth and consulting, formed a micro-corporation and used a Solo 401(k) to shelter $66,000 in 2024 income, reducing her tax burden by over $22,000.

💼 Need guidance setting up your own micro-corporation?

Download our “Micro-Business Formation in 10-Steps” eBook →

Step 5: Execute a Backdoor Roth IRA

For physicians exceeding Roth contribution limits, the Backdoor Roth IRA remains a powerful strategy.

-

Contribute to a non-deductible traditional IRA.

-

Convert to a Roth before earnings accumulate.

Tax advantage: You get tax-free growth and withdrawals—hedging against future tax hikes while creating flexibility.

📘 Explore how to stack these moves with a side gig in our “Tax Deduction Guide For Micro-Business Owners” →

Step 6: Real Estate—The Physician’s Wealth Multiplier

After retirement accounts, real estate can offer depreciation, 1031 exchanges, cost segregation, and passive income. Many doctors—including myself—have used short-term rentals to supercharge returns.

PEA Pro Tip: If your spouse qualifies as a Real Estate Professional, you could use paper losses to offset W-2 or 1099 income.

🏡 Read how I use real estate and REPS in this eBook: “3 Real Estate Tax Strategies for High Income Professionals” →

Step 7: Use a Taxable Brokerage—Smartly

Once your tax-advantaged accounts are filled, a taxable brokerage gives you investment flexibility. Stick with index ETFs, municipal bonds, and tax-loss harvesting strategies.

This tier supports mid-term goals like a sabbatical, business capital, or your child’s med school tuition (paid without penalties!).

👉 I recommend Earned Wealth Management to help you with this.

Step 8: Consider High-Risk or Special Opportunities

Angel investing, private equity, even cryptocurrency—these sit at the top of your waterfall and should be funded only with surplus capital.

Rule of thumb: Cap these at 5-10% of your portfolio. They can pay off big—but they’re not for your foundation.

Throwback Wisdom: From W-2 Prison to Freedom Flow

Years ago, I wrote about the trap of thinking your income equals your wealth. It doesn’t. It’s retained income—what you keep—that makes the difference. And nothing increases retained income like a tax-aware investment flow.

🔁 Read more in my archive post “Retained Income: How To Keep More and Work Less” →

The Waterfall Is Your New Financial Blueprint

This isn’t just about investing. It’s about thinking like a physician-entrepreneur. Every dollar you earn has a job—and every investment you make can either be taxed once, taxed twice, or not taxed at all.

By following this waterfall, you build a protective moat around your freedom—allowing you to say yes to what matters and no to what doesn’t.

🧭 Ready to get serious about your money mindset?

🚪 Identity Shift Step:

Still thinking like an employee? It’s time to own your time, your work, and your income.

👉 Start Your Transition with PEA Explorer Membership → OR

📘 Download my free e-book “Mindset Shift Mapping” to rewire your financial trajectory →

If you want 1:1 support implementing this waterfall with your micro-business income, I offer personalized coaching through my business strategy sessions.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.