Unlock Your Earnings: Physician Accountable Plan Tax Strategy

Sep 26, 2025

Unlock Your Earnings: Physician Accountable Plan Tax Strategy

Implementing a physician accountable plan tax strategy can transform how you handle day-to-day expenses, turning out-of-pocket costs into tax-efficient reimbursements. When you set up an IRS-approved reimbursement arrangement, you remove qualifying business expenses from your taxable income without triggering additional payroll tax. This approach can boost your after-tax earnings and streamline your practice’s financial management.

An accountable plan is more than a bookkeeping tool—it is a compliance framework that defines eligible expenses, documentation standards, and reimbursement procedures. Unlike non-accountable arrangements, reimbursements under an accountable plan are not reported as income on W-2 forms and avoid Social Security and Medicare withholding. By following IRS gui

delines, you ensure reimbursements remain tax-free for both yourself and any staff involved.

In this article, you’ll explore what constitutes an accountable plan, learn how to set one up step by step, discover strategies to maximize your deductions, and understand compliance best practices. Whether you’re a solo practitioner, part of a group practice, or exploring advanced tax planning for your micro-business, this guide will equip you with a clear path to unlock savings and maintain audit-ready records.

Understand accountable plans

What is an accountable plan?

An accountable plan is a written reimbursement policy that lets you pay yourself or your employees for business expenses on a non-taxable basis. Under this arrangement, the practice treats eligible out-of-pocket costs as deductible expenses, while reimbursements stay off W-2 forms and bypass payroll taxes. For physicians, nurse practitioners, physician assistants, and other clinicians, this means you can cover costs like licensure fees, continuing education, travel, and professional dues without inflating taxable income.

IRS criteria and guidelines

To qualify, an accountable plan must meet three key IRS requirements:

-

Business connection — Expenses must relate directly to the practice or its services.

-

Timely reporting — Employees or owners submit expense reports within a reasonable period, typically 60 days.

-

Substantiation — Receipts, mileage logs, and other documentation must support each expense.

-

Return of excess — Any advance or overpayment must be returned within a set timeframe, usually 120 days.

Meeting these rules ensures reimbursements remain tax-free. Failing any one element converts the arrangement into a non-accountable plan, making reimbursements taxable and subject to withholding.

Set up your plan

Draft a written policy

Begin by creating a clear, written reimbursement policy that outlines:

-

Who participates — Specify whether only physicians, clinical staff, or all employees are eligible.

-

Eligible expense categories — List items such as medical equipment, professional association dues, and travel costs.

-

Reporting deadlines — Set deadlines for submitting expense reports and returning excess funds.

-

Approval workflow — Define who reviews and approves each claim.

Store this policy in your practice’s compliance binder and share it with your accountant or payroll provider.

Identify eligible expenses

Common expense categories include:

-

Continuing medical education and conference fees

-

Malpractice insurance premiums

-

Business travel lodging, meals, and transportation

-

Office supplies and medical equipment

-

Home office utilities (if you maintain an approved home workspace)

You can expand or restrict categories based on the practice’s needs, but each must satisfy the IRS business-connection rule.

Define substantiation requirements

Specify the documentation you’ll accept:

-

Itemized receipts showing vendor, date, and amount

-

Mileage logs with trip purpose and odometer readings

-

Credit card statements annotated with business purpose

-

Conference brochures or registration confirmations

Require staff and owners to attach original receipts and complete standardized forms. Electronic submissions can streamline processing but retain originals for audit defense.

Establish reimbursement process

Outline steps for processing claims:

-

Employee or owner completes an expense report form.

-

Submit supporting documents to the designated approver.

-

Approver verifies eligibility and documentation.

-

Payroll or accounting issues non-taxable reimbursement.

-

Any excess advance is returned within 120 days.

Integrate this workflow into your payroll system or use a dedicated expense-management tool to automate approvals and record keeping.

Submit reimbursement claims

Track out-of-pocket expenses

Consistent expense tracking is the foundation of any accountable plan. Use one or more of these methods:

-

Mobile receipt apps that scan and categorize expenses

-

Spreadsheet templates with built-in mileage calculators

-

Dedicated practice management software with expense modules

Encourage timely submissions by setting weekly or biweekly cut-off dates.

Timely expense reporting

IRS guidelines require reasonable periods for you or your staff to submit claims—typically within 60 days of incurring the expense. Late submissions can jeopardize the tax-free status of reimbursements. To enforce this:

-

Send calendar reminders before deadlines

-

Provide clear instructions on your expense form

-

Schedule periodic compliance audits to catch late reports

Return excess reimbursements

If an advance exceeds actual expenses, the overage must be returned within 120 days. Track advances separately and flag any differences promptly. Have employees write a check or process a reverse reimbursement through payroll to correct overpayments.

Maximize your deductions

Common deductible expenses

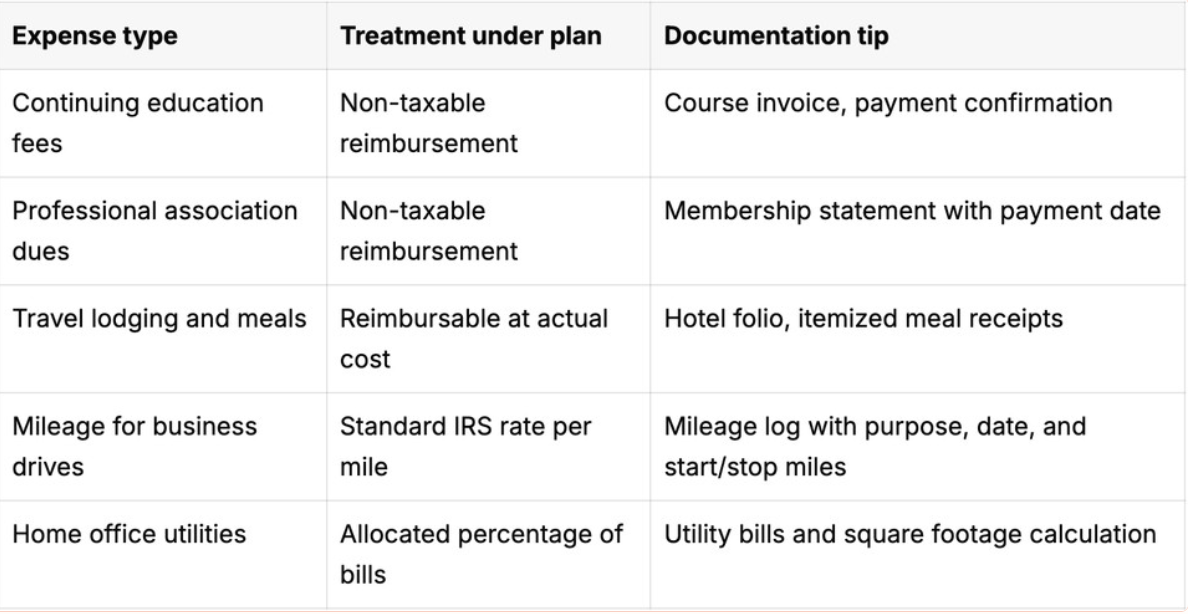

Under an accountable plan, you can deduct a wide range of business costs. Use this table to guide your policy:

Refer to The Ultimate Guide For Business Expenses for additional expense categories and best practices.

Leverage tax-free reimbursements

Because reimbursements under an accountable plan do not count as taxable income, you:

-

Reduce your reported wages on W-2 forms

-

Avoid both employer and employee payroll tax on reimbursed amounts

-

Keep more cash flow for reinvestment or retirement contributions

Integrate reimbursements into your overall tax-planning strategy by aligning them with year-end tax forecasts.

Integrate with payroll

Work with your payroll provider or use an in-house system to:

-

Code reimbursements separately from wages

-

Exclude reimbursements from Social Security, Medicare, and unemployment calculations

-

Generate custom reports for tax filing and audit support

A robust payroll setup minimizes manual work and lowers the chance of reporting errors.

Ensure ongoing compliance

Maintain documentation

An audit-proof accountable plan depends on meticulous record keeping. Keep all expense reports, receipts, and approval logs for at least seven years. Organize records by:

-

Date of expense

-

Employee or owner name

-

Expense category

Digital backups complement paper files, ensuring quick retrieval.

Conduct periodic reviews

Schedule quarterly or semi-annual reviews to verify:

-

Policy adherence by staff

-

Submission timeliness

-

Accuracy of reimbursements

-

Return of any excess advances

Review meetings help identify gaps and reinforce the importance of compliance.

Prepare for audits

Though an IRS audit of your practice is rare, you can be ready by:

-

Maintaining a compliance binder with your written policy

-

Storing organized expense reports and receipts

-

Documenting internal reviews and corrections

-

Having your accountant sign off on plan compliance

This level of preparedness demonstrates professionalism and reduces audit stress.

Avoid common pitfalls

Treat reimbursements correctly

Misclassifying reimbursements as wages can trigger payroll tax liabilities and penalties. Always process reimbursements through your accountable plan workflow, not as payroll earnings.

Prevent non-accountable plan risks

A non-accountable arrangement arises if you skip any IRS criteria—business connection, timely reporting, substantiation, or return of excess. Non-accountable payments become taxable wages and require withholding, negating the strategy’s benefits.

Resolve documentation gaps

Missing receipts or vague expense descriptions can lead to denied reimbursements or IRS adjustments. To avoid this:

-

Provide staff training on your documentation requirements

-

Use standardized forms with clear instructions

-

Reject incomplete reports and request resubmission promptly

Explore case studies

Solo practitioner example

Dr. L runs a solo family medicine practice. By implementing an accountable plan, she:

-

Reimburses licensure fees, conference travel, and CME costs

-

Removes $7,500 annually from her 1099 income

-

Saves approximately $1,200 in payroll taxes every year

With clear documentation and quarterly reviews, Dr. L has maintained audit-ready records for five years.

Group practice example

A three-physician orthopedic group introduced an accountable plan covering:

-

Team travel to medical conferences

-

Shared office supplies and equipment leases

-

Home office expenses for part-time support staff

They have seen a combined payroll tax savings of over $15,000 annually and improved staff satisfaction by reimbursing business outlays promptly.

Access resources and tools

-

Template: Sample accountable plan policy and expense report form

-

Checklist: Key compliance steps for first-year implementation

-

Article: Health Insurance Reimbursements doctors should not miss

Use these resources to accelerate setup, train your team, and keep your plan compliant.

Plan your next steps

Recap key actions

-

Draft and approve your written policy.

-

Define eligible expenses and substantiation rules.

-

Implement a streamlined reimbursement workflow.

-

Maintain records, conduct reviews, and prepare for audits.

Book a strategy session

If you want personalized guidance on deploying this tax strategy and integrating it with your overall planning, consider booking a one-on-one consultation with me at PEA. Although I am not an accountant, I am an experienced physician with plenty of professional resources to help you with your next step.

Unlock the full potential of your practice’s earnings by turning expenses into tax-efficient reimbursements and reinforcing your status as a savvy steward of your business finances.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.