What Is a Micro-Corporation—and Is It the Same as a Micro-Practice?

May 23, 2025

💡 Today’s Micro-Business Tactic: What Is a Micro-Corporation—and Is It the Same as a Micro-Practice?

When I talk with physicians about becoming self-employed, I often hear confusion between two important concepts: a micro-corporation and a micro-practice. Many doctors assume they’re one and the same. But if you're considering stepping out of traditional employment, this distinction matters—a lot.

Let me walk you through what a micro-corporation really is, how it's different from a micro-practice, and why this understanding will help you build a lean, agile, and profitable career.

🧾 What Is a Micro-Corporation?

When I use the term micro-corporation in reference to non-employed/self-employed doctors, here’s what I mean:

-

✅ You’re a single-member business—you’re likely the only employee and owner.

-

✅ Your business model is lean—your only product is your professional services.

-

✅ You’re flexible in the marketplace—mobile, virtual, and adaptable.

-

✅ Your business entity is your choice—unincorporated (sole proprietor, LLC) or incorporated (PC, PLLC, PA).

-

✅ You choose your federal tax classification—including S-Corp election for tax savings.

In short, a micro-corporation is about how you operate as a business, not what kind of practice you run.

Many physicians start as sole proprietors because it’s simple: no formal business setup, no extra tax filings. But here's the catch—you also have no liability protection. That’s a dangerous game for any high-net-worth professional. I always recommend forming a true legal entity—ideally a professional LLC or PC—and electing S-Corp status for optimal liability protection and tax strategy.

👉 Want to learn why every doctor should form a micro-corporation? Download this free guide →

🧠 How Is That Different From a Micro-Practice?

While a micro-corporation is about business structure, a micro-practice is about how you deliver care.

A micro-practice typically refers to:

-

A small, often solo, clinical practice—with or without a physical location.

-

May be cash-only or hybrid billing.

-

Has minimal staff or overhead—maybe just you and a part-time MA or virtual assistant.

-

Is often focused on niche, high-touch, or direct care services (e.g., obesity management, telehealth, DPC).

You can run a micro-practice inside your micro-corporation, but the two are not interchangeable. One is legal/tax identity, and the other is your clinical business model.

One the most common types of micro-practices today is a DPC.

➡️ Download our PEA Guide To Starting Your DPC Practice

🧑⚕️ Case Study: Dr. Kim's Marketplace Pivot

Dr. Kim was a seasoned hospitalist burned out by 12-hour shifts and administrative bloat. She wanted a more flexible career and began exploring telehealth side gigs. At first, she simply received 1099 income and reported it as a sole proprietor.

But after joining PEA-SimpliMD, she learned about the micro-corporation model and formed a PLLC with S-Corp election. She began funneling all her marketplace work (telehealth, legal reviews, and eventually a virtual micro-practice for weight loss) through her micro-corporation.

Her micro-practice was built on top of her micro-corporation, giving her:

-

⚖️ Legal protection

-

💰 Tax efficiency (saving ~$18,000/year in self-employment taxes)

-

📈 The ability to scale slowly and add income streams

She didn’t need a physical clinic or staff—just a laptop and a license.

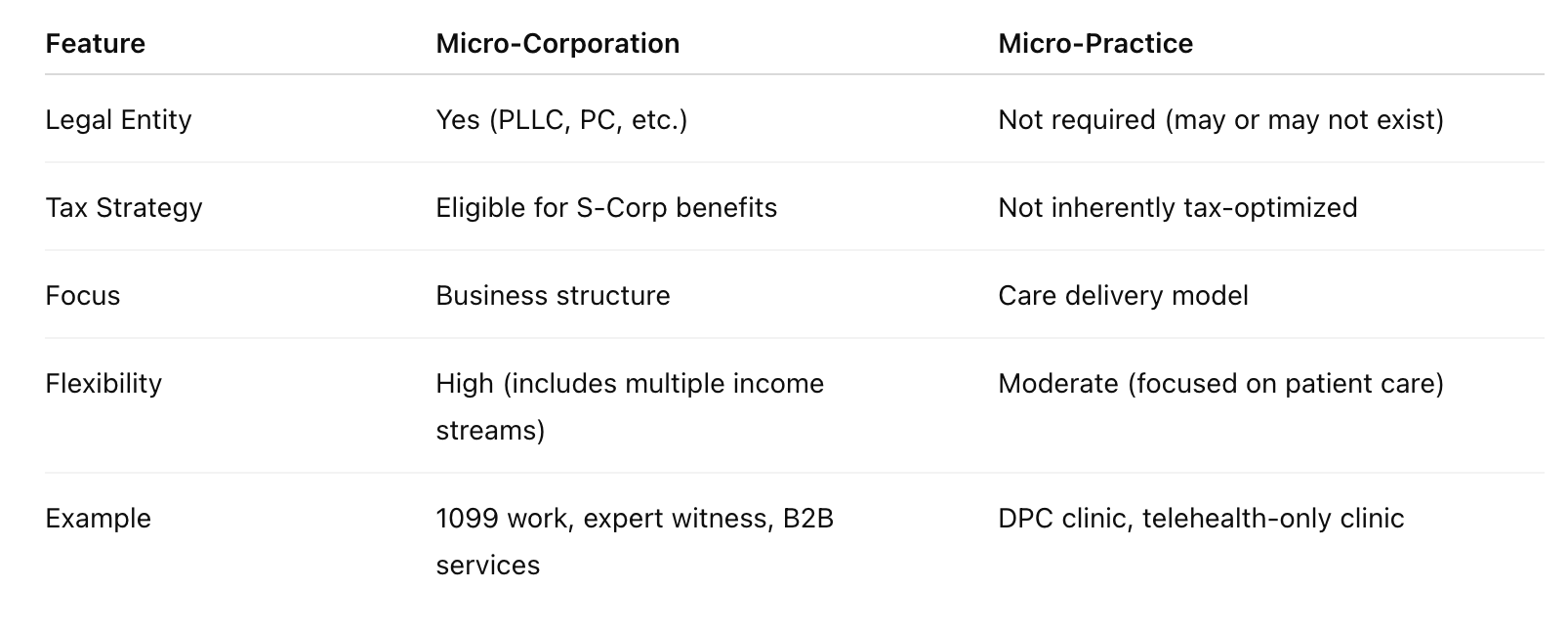

📝 Key Differences Between Micro-Corporation and Micro-Practice

🧰 Tool of the Week: Micro-Business Formation 10 Step Guide

This downloadable guide walks you step-by-step through launching your micro-corporation, including:

-

Choosing your entity structure

-

Registering with your state

-

Setting up your S-Corp election

-

Establishing a business bank account

-

Managing legal and compliance basics

➡️ Download Now → Micro-Business Formation Guide

💬 Lessons from the Field

“One of my coaching clients realized their ‘side gig’ was generating $120,000/year—but they had no formal entity, no tax plan, and zero liability protection. We transitioned them into a micro-corporation with an S-Corp election and saved them $25K in taxes and countless headaches.”

📚 Bonus Reading from The Independent Physician Blog

Keep going deeper with these companion posts:

🚀 Scale with Coaching CTA

Want personal guidance to set up your micro-corporation the right way? We’ll help you cut through the legal, tax, and business fog with 1:1 strategy sessions tailored to physicians.

➡️ Book a Strategy Consultation Session

➡️ Get Started With 1:1 Business Coaching Today

📥 Grab Your Free E-Book

🎁 Download your free copy of “Why Every Doctor Should Form a Micro-Corporation” and learn how to protect your assets, cut your tax burden, and increase your autonomy

📥 Start My Mega Course

➡️ Jump in and get started with my course: Doctor, You Are Business that provides everything you need to know to thrive in the marketplace.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.