Why Employment Lite Is the Best Way to Change Jobs—Without Moving

May 05, 2025

Why Employment Lite Is the Best Way to Change Jobs—Without Moving

There’s a recurring conversation I’ve had with countless physicians during business coaching sessions. It goes something like this:

“Tod, I need a new job. I’m burned out. But I can’t move—my family’s rooted here. What do I do?”

I get it. The kids are in school, your spouse has a career, and the idea of uprooting your life for a job is—honestly—maddening. That’s why I want to talk about a quiet revolution that’s changing the game for doctors like you: employment lite.

This hybrid model lets you change your work life without changing your home life. And it’s not just theory—I’ve walked this path myself and guided dozens of others through it.

Where I Was: Stuck Between Burnout and a Zip Code

Several years ago, I found myself teetering on the edge of burnout. The clinical grind was unrelenting, but I loved my rural community, my church, my patients. Moving away to chase a better job wasn’t an option.

I needed a new model—a way to pivot without packing boxes.

That’s when I discovered what I now call “employment lite”: a hybrid model of independent 1099 work wrapped inside your own micro-corporation. You keep your autonomy and flexibility, but you also keep your zip code along with your current job.

What Happened: I Took the Leap Without the Move

Instead of seeking a traditional job elsewhere, I created my own opportunity. I began contracting directly with clinics and hospitals on my terms. I job stacked by converting my primary job from a W-2 contract to 1099 based PSA aka employment lite. In essence, I became a long-term independent contractor with my former employer and then I added in contracted medical directorships at a nursing home, expert witness work, and hospital call gigs—all while staying planted in my community.

This approach gave me financial upside, lifestyle control, and—most importantly—freedom.

What I Learned: The Power of “Leasing Yourself”

The traditional employment model treats doctors like assets to be owned. Employment lite flips that. You become a professional service provider—a business leasing your expertise. You call the shots.

And when you operate as a micro-business? You’re not just a doctor—you’re a business machine with downstream revenue potential, tax advantages, and strategic flexibility.

Case Study: Transitioning from W-2 to 1099 – A Pediatric Hospitalist's Experience

Background: A pediatric intensive care hospitalist was employed full-time under a W-2 contract in Wisconsin. He accepted a new full-time W-2 position in Ohio but was approached by his former Wisconsin employer to continue working one week per month until a replacement was found.

Challenge: The hospital preferred to retain him as a W-2 employee, covering malpractice insurance, travel, and lodging. However, the physician recognized that remaining a W-2 employee would limit his tax planning opportunities and result in higher tax liabilities.

Solution: He proposed transitioning to a 1099 independent contractor arrangement. To support his proposal, he created a detailed spreadsheet demonstrating the financial benefits for both parties.

Benefits for the Physician:

-

Tax Deductions: As a 1099 contractor, he could deduct business-related expenses such as travel, lodging, and malpractice insurance. Additionally, he could set up a solo 401(k) or SEP IRA, allowing significant retirement contributions that reduce taxable income.

-

Income Splitting: By forming an PLLC taxed as an S-corporation, he could pay himself a reasonable salary and take the remaining income as distributions, potentially reducing self-employment taxes.

-

Flexibility: Operating as a 1099 contractor provided greater control over his schedule and the ability to pursue additional opportunities.

Benefits for the Employer:

-

FICA Savings: The hospital would no longer be responsible for the employer portion of Social Security and Medicare taxes (7.65% of the employee’s salary).

-

Benefits Savings: The hospital could avoid costs associated with providing health insurance, retirement contributions, and other employee benefits.

Outcome: Despite initial resistance, the hospital agreed to the 1099 arrangement after recognizing the mutual financial benefits. This transition allowed the physician to retain more income while providing the hospital with cost savings.

Source: SimpliMD Blog – Job Stacking 1099 Income for Tax Efficiency

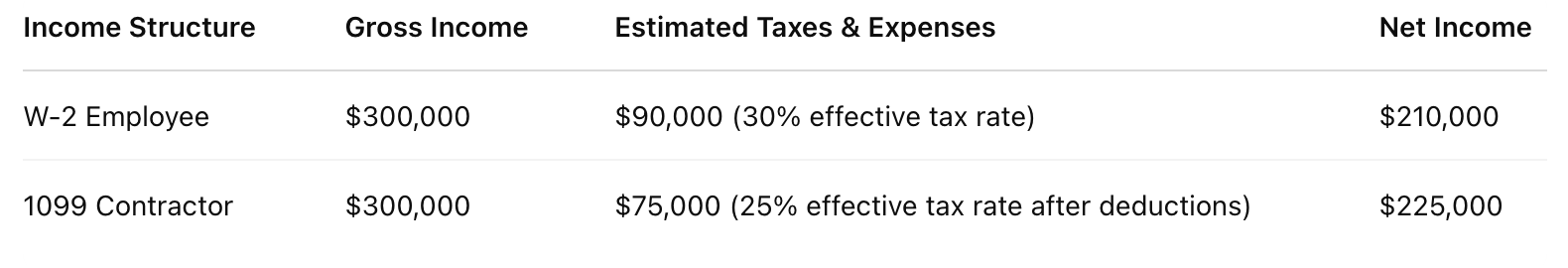

Financial Comparison: W-2 vs. 1099 Income

Let's consider a simplified financial comparison based on the case study:

Note: These figures are illustrative and actual tax rates and deductions will vary based on individual circumstances.

Key Takeaways

-

Tax Efficiency: Transitioning to a 1099 contractor allows for various tax deductions and retirement planning strategies that can significantly reduce taxable income.

-

Increased Flexibility: Independent contracting offers greater control over work schedules and opportunities to diversify income streams.

-

Mutual Benefits: Both physicians and employers can realize financial advantages through 1099 arrangements.

The Micro-Business Insight: You Don’t Need Permission to Change

One of the biggest misconceptions I see in doctors is the belief that change requires external permission: from a hospital, a recruiter, or a job board.

Wrong.

Change comes from structuring yourself as a business. When you do that, you can pivot within your current geography—just like I did, and just like our pediatric hospitalist did.

The best part? You don’t need to burn bridges. Many doctors start their employment lite path by talking with their current employer about shifting into an independent contractor role—one that benefits both parties.

Want help with that conversation?

Download our free guide: 📥 Tips for Talking to Your Employer About Employment Lite

📬 Join the Movement

“Build your own dreams, or someone will hire you to build theirs.” – Farrah Gray

Thousands of physicians are reclaiming their lives through micro-business ownership. Are you ready to join them?

👉 Join the PEA Explorer Membership

You'll get access to my Employment Lite Resource Kit, including:

-

Independent Contractor vs. Employee Primer

-

What It Means to Be a Long-Term Independent Contractor

🧾 “Is This Deductible?”

Yes, my recent coaching session to talk about my next business move was deductible. If your meeting was a business strategy conversation and held in your home or a location eligible under the Augusta Rule, it may qualify.

📘 Learn about the Augusta Rule →

Tools to Help You Change Jobs Without Moving

✅ Comprehensive Employment Lite Program – $2,999 Includes everything you need to pivot—PEA Pro Membership, 4-Pack Coaching, and my full Employment Lite Resource Kit.

✅ Free E-book: Why Every Doctor Should Form a Micro-Corporation Understand the business model behind job mobility without relocation.

✅ Professional Business Entity Formation Guide If you're just getting started, this guide simplifies your business entity formation process.

Final Thought

You don’t have to move to change your life.

In fact, the smartest physicians I know are staying put—but changing how they work by embracing employment lite. They’re becoming self-leasing business machines with staying power.

If you’ve been waiting for a sign to make a change—this is it.

Let’s build your next chapter—without the moving truck.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.