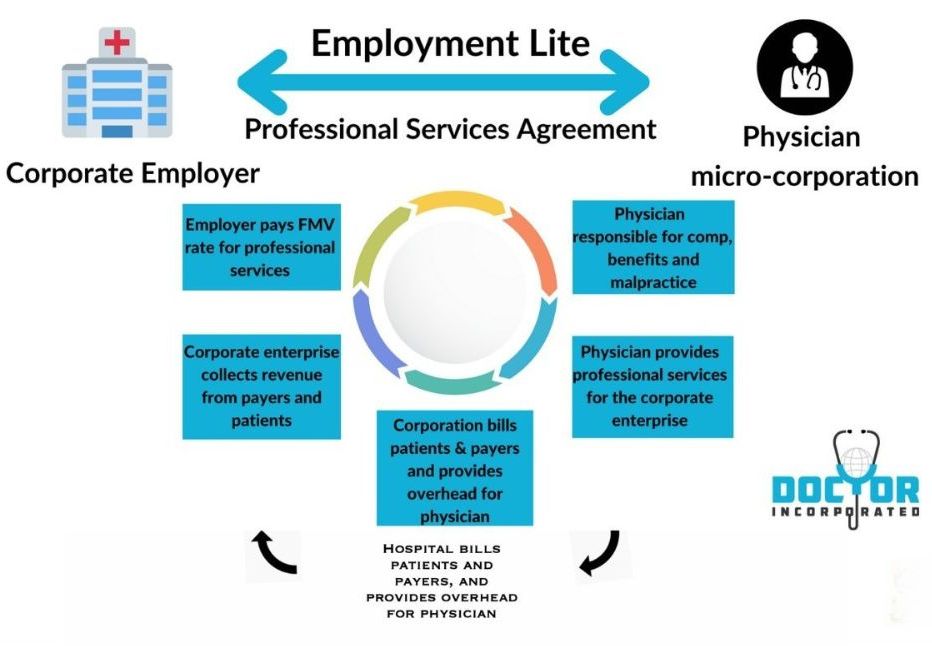

The Employment Lite Program is a proven strategy to help physicians create a hybrid career model—maximizing income, minimizing taxes, and reclaiming professional autonomy.

Diversify your revenue streams through telemedicine, concierge care, and virtual services

Create a sustainable, stress-free career that aligns with your lifestyle

Regain control over your schedule, income, and patient care

Why Employment Lite is the Smartest Career Move for Physicians

High Taxes

Employed physicians face some of the highest tax burdens of any profession.

Lack of Career Control

W-2 employment leaves doctors with limited say over schedules, patient loads, and medical decisions.

Limited Financial Flexibility

Physicians tied to a single employer have fewer options to build diversified income streams.

Increased Burnout

Long hours, administrative burdens, and lack of control over your practice model increase stress and dissatisfaction.

Want More Endorsements & Deeper Dives Into PSAs & Employment Lite?

Download Coker Group's White Paper on PSAsEmployment Lite Combines the Best of Both Worlds

- Keep the security of your W-2 employment while gaining the financial and tax advantages of a micro-corporation.

- Reduce taxes, retain more income, and leverage business structures to improve wealth accumulation.

- Gain greater autonomy and control over your schedule, contracts, and professional decisions.

Request a Private Consultation to See If Employment Lite Is Right for You

See If You Qualify

We Offer Two Programs To Match Your Budget

✅ The Lean Comprehensive Employment Lite Program

Break free from W-2 limitations without losing alignment.

Are you ready to take control of your professional life, preserve institutional relationships, and unlock the full benefits of self-employment—without navigating it all on your own?

The Lean Comprehensive Employment Lite Program is your step-by-step guide to launching a physician micro-business that thrives under a flexible, independent contractor model. Whether you're negotiating a PSA, forming your professional entity, or simply transitioning out of traditional employment, this program removes the guesswork and equips you with every resource needed to succeed.

🔍 What You’ll Receive — For only $2999, Yours With an Amazing Value of $6,000+ :

We’ve bundled the best of PEA-SimpliMD into one affordable package—giving you everything you need, nothing you don’t:

-

✅ PEA Pro Membership – Full access to our premium Physician Entrepreneur Academy resources ($999 value)

-

🧭 4-Pack of Private Business Coaching Sessions – Hands-on support to guide your Employment Lite journey ($2,000 value)

-

📚 “Creating a Practice Without Walls” Course – Learn how to structure your modern, mobile micro-corp ($497 value)

-

📚 “Doctor, You Are a Business” Course – Master the entrepreneurial mindset and skills every independent doctor needs ($1,999 value)

-

🧾 Business Plan Bundle – Ready-to-use templates to create your customized business roadmap ($99 value)

-

✅ 1:1 Strategic Consultation – A personalized launch session + 12 months of unlimited follow-up strategy and implementation meetings and email support ($500+ value)

-

✅ Employment Lite Resource Kit – Proprietary resources that make negotiation and implementation seamless

-

✅ Micro-Corporation Formation & Setup Tools – Save time with curated documents, checklists, and vendor referrals

💼 À la Carte Expert Network (Optional Add-Ons Priced Separately):

We connect you to vetted professionals who understand physician-specific micro-corporations and Employment Lite structures:

-

📝 PSA Contract Diagnostics & Compensation Analysis

-

⚖️ Business Formation via PEA Legal Network

-

💵 CPA + Accounting Referrals tailored to micro-corp tax strategies

-

📈 Wealth Management Guidance with long-term growth in mind

🎯 Why This Program Works

Most doctors waste time trying to figure it out on their own—or worse, lean on advisors who don’t understand the nuances of physician entrepreneurship. This program keeps things lean by cutting out bloated costs and unnecessary fluff, while still giving you high-impact coaching, tools, and access to the right professionals.

You don’t need an MBA. You need a proven path. This is it.

🔐 Take the First Step to Professional Freedom

This program is ideal for:

-

Physicians seeking contract flexibility without moving

-

Doctors looking to retain more income with the same job

-

Professionals ready to stop being treated like an employee—and start acting like a business

🏛️ White Glove Comprehensive Employment Lite Program

The Premium, Done-For-You Launch of Your Physician Micro-Corporation

You’ve made the decision to step out of traditional employment. Now let SimpliMD build the infrastructure beneath your new professional identity—with concierge-level service, elite advisors, and total support from day one.

The White Glove Comprehensive Employment Lite Program is our most premium service offering: an expertly coordinated, physician-specific solution that includes everything required to form, structure, and launch your micro-corporation under an Employment Lite contract—without lifting a finger.

We do it all—legal, tax, payroll, compliance, benefit sourcing, strategic planning, and PSA onboarding. All through a turnkey, physician-first process executed by vetted experts who understand your profession.

💼 Total Investment: $31,500

-

Initial Deposit: $5,000

-

Remaining Setup & Onboarding: $26,500

Includes all start-up costs and coordination across legal, tax, coaching, and strategic domains. This is a one-time investment to get your micro-corporation fully formed and implemented.

✅ What’s Included: Start-Up Program Scope of Services

Delivered by SimpliMD + Our Vetted Network of Professionals

🏛️ Legal Formation & Compliance

-

Corporation naming, bylaws, registered agent, Articles of Incorporation

-

EIN filing, business entity report, medical board registration

-

3 months of legal tail support through Lattice Legal

-

PSA review and redlining for Employment Lite agreement

-

Annual corporate meeting note templates

💰 Accounting & Tax Setup

-

Payroll for owners/family

-

Bank reconciliation, QuickBooks setup

-

Quarterly estimated taxes + IRS guidance

-

Setup of 1099s, invoicing, and tax structure planning

📈 Strategic Business Coaching

-

4-Pack Business Coaching + 12 months of support

-

SimpliMD onboarding toolkit (budget templates, DURP guides, etc.)

-

Goal-setting, entity-level planning, and early growth support

💼 Wealth & Retirement Planning

-

Connection with SimpliMD-vetted advisors (or your own)

-

Integration of retirement planning into corporate strategy

-

Consolidation of existing retirement assets into PC structure

🌐 Ongoing Communication

-

Central coordination across legal, tax, and financial providers

-

Document collection, onboarding scheduling, and compliance monitoring

📚 All Lean Program Products Included:

-

✅ PEA Pro Membership

-

📚 Two flagship courses: Doctor, You Are a Business & Creating a Practice Without Walls

-

🧾 Business Plan Bundle

-

✅ Employment Lite Resource Kit

-

✅ Micro-Corp Formation Templates

-

✅ Unlimited email support

🔁 Ongoing Success: PEA Maintenance Program (additional $19,900/year)

Once your micro-corp is live, our Annual Maintenance Program ensures your entity remains compliant, efficient, and profitable. With comprehensive accounting, legal oversight, business coaching, and wealth guidance—delivered as a coordinated, proactive service.

🛠️ Annual Maintenance Services Include:

💵 Accounting & Tax

-

Payroll, reconciliation, quarterly payments, and 1120/1040 returns

-

Annual P/L and personal & corporate tax filings

-

Corporate invoice processing and 1099 issuance

-

Triennial tax planning meetings

-

Live email/phone support for financial questions

📊 Business Coaching

-

Quarterly business coaching check-ins

-

Personal + professional goal alignment

-

Strategic growth planning, DURP review, and compliance assistance

-

Tax strategy and benefit coordination

💼 Wealth Strategy & Coordination

-

Semiannual fiduciary meetings

-

Tax-advantaged retirement plan management

-

Consolidation of previous investment accounts

⚖️ Legal Compliance (via PEA Legal Partner)

-

4 hours of legal services annually

-

Annual meeting minutes + business report filing

-

Legal review of corporate financials as needed

-

Fixed $495/hour for additional services

🎁 PEA Pro Member Benefits

- ✔ Invitation to Periodic Private PEA Boardroom Mastermind Meetings

- ✔ Elite access to PEA's Build Your Business Team Guide

- ✔ Exclusive member benefit: The Micro-Business Vault—10 Hidden Revenue Streams for Physician Entrepreneurs

- ✔ Gain exclusive access to sponsorship opportunities through targeted e-blasts and prime placement in our widely read PEA-SimpliMD Digest newsletter—putting your business directly in front of an engaged, like-minded audience.

- ✔ Elevate your visibility with premium brand and business exposure through featured blog spotlights and digital showcases designed to tell your story and amplify your entrepreneurial journey

- ✔ Step into high-level joint venture opportunities with PEA-SimpliMD and our growing ecosystem—co-creating value, expanding your reach, and building something meaningful alongside trusted physician-entrepreneurs.

- ✔ Unlock over $5,000 worth of premium business-building tools, visibility opportunities, and strategic collaborations—all included in your PEA Pro membership for just $999.

🧭 From Launch to Legacy—We’re With You Every Step

The White Glove program is ideal for:

-

Physicians who want everything handled with concierge-level execution

-

Doctors transitioning to Employment Lite who value elite service and expert coordination

-

Professionals building long-term, tax-efficient business infrastructure

This is not just a setup. It’s your launch into entrepreneurial autonomy—with a built-in support system to ensure success.

Get Started With The First Step Of Your White Glove Service

PEA Lean Comprehensive Employment Lite Program

Are you ready to break free from W-2 limitations and create your own pathway to professional autonomy—without giving up alignment with healthcare institutions? The Comprehensive Employment Lite Program is the most robust, physician-focused training and coaching solution available today. Whether you’re negotiating a PSA contract, forming a micro-corporation, or transitioning out of traditional employment, this program gives you every tool and expert resource you need to confidently operate as a long-term independent contractor. What You’ll Receive: What You’ll Receive:✅ PEA Pro Membership ($999 Value)🧭 4-Pack of Business Coaching Sessions ($2000 value)📚 “Creating A Practice Without Walls' Course ($497 Value)”📚 “Doctor, You Are A Business’ Course ($1999 Value)”🧾 Business Plan Bundle ($99 value)✅ 1:1 Strategic Business Consultation with Unlimited follow-up consulting sessions and email access for 12 months ($500+ value)✅ Employment Lite Resource Kit (Exclusive PEA Resource)✅ Micro-Corporation Formation & Setup Resources✅ Expert guidance to à la carte professionals who will support your transition (costs are separate and vary):📝 Contract Diagnostics PSA Review & Compensation Analysis⚖️ PEA Legal Network for Business Formation💼 Wealth Management & Strategy Referral💵 CPA-Accounting Network Referral

$2,999.00 USD

PEA White Glove PC-Employment Lite Comprehensive Program Step 1

Before we begin building your micro-corporation and Employment Lite arrangement, we start with a thorough Feasibility Study to ensure the model will deliver the results you expect—especially when it comes to tax efficiency, income retention, and household-level financial benefits. This in-depth analysis is the foundation of our white-glove service. We evaluate your unique professional and financial situation, run projected savings scenarios, and identify the ideal structure and support team for your transition. Think of it as a personalized blueprint that determines whether moving forward will create meaningful value for you and your family. If the feasibility confirms it’s a green light, we then move into Step 2—full implementation and long-term support through our expert network. What’s Included: Start-Up Program Scope of Services Delivered by SimpliMD + Our Vetted Network of Professionals 🏛️ Legal Formation & Compliance Corporation naming, bylaws, registered agent, Articles of Incorporation EIN filing, business entity report, medical board registration 3 months of legal tail support through Lattice Legal PSA review and redlining for Employment Lite agreement Annual corporate meeting note templates 💰 Accounting & Tax Setup Payroll for owners/family Bank reconciliation, QuickBooks setup Quarterly estimated taxes + IRS guidance Setup of 1099s, invoicing, and tax structure planning 📈 Strategic Business Coaching 4-Pack Business Coaching + 12 months of support SimpliMD onboarding toolkit (budget templates, DURP guides, etc.) Goal-setting, entity-level planning, and early growth support 💼 Wealth & Retirement Planning Connection with SimpliMD-vetted advisors (or your own) Integration of retirement planning into corporate strategy Consolidation of existing retirement assets into PC structure 🌐 Ongoing Communication Central coordination across legal, tax, and financial providers Document collection, onboarding scheduling, and compliance monitoring 📚 All Lean Program Products Included: ✅ PEA Pro Membership 📚 Two flagship courses: Doctor, You Are a Business & Creating a Practice Without Walls 🧾 Business Plan Bundle ✅ Employment Lite Resource Kit ✅ Micro-Corp Formation Templates ✅ Unlimited email support

2 monthly payments of $2,500.00 USD

What’s Included in White Glove Comprehensive Employment Lite Program?

We source, set up, and subcontract out all of the integrated professional services needed for getting started and then operating your micro-corporation with your PSA, aka Employment Lite Agreement. We'll connect you to experienced legal, accounting, wealth management, and business professionals who understand the playbook involving micro-corporations and PSAs. They are knowledge about small business tax planning and have worked with physicians from all over the country to help them thrive as independent medical professionals.

This white glove service makes it simple and easy as PEA helps manage every step of your full transition, supporting you before, during, and after things are rolling.

**We recommend to plan for 6 months for the entire process to be completed**

Initial Setup

$31,500

One-Time Fee & Includes Feasibility Step

- Full strategic assessment of your current employment structure.

- Customized business entity formation with legal and tax guidance.

- Contract review and negotiation support with your employer.

- Establishment of tax-optimized payment structures.

- Introduction and onboarding to a professional network (lawyer, CPA, wealth manager, and business coach).

Annual Maintenance

$19,900

Per Year paid through Quarterly Invoices

- Quarterly business strategy coaching from Dr. Tod Stillson.

- Ongoing contract updates and tax efficiency reviews.

- Support with diversified income streams and new business models.

- Access to the exclusive PEA Pro Membership with expert masterclasses, exclusive content, and private events.

How the Employment Lite Model Works

You Keep Your W-2 Job

Maintain employment stability with your hospital or employer.

Continue receiving benefits (healthcare, retirement plans, etc.).

You Get Paid Through Your Micro-Corporation

Leverage tax-efficient payment structures.

Keep more of your hard-earned income while reducing taxes.

You Establish a Professional Micro-Corporation

Operate as an independent contractor within your existing employment.

Structure your income to maximize tax benefits and reduce overall liability.

You Gain Financial & Professional Control

Control your schedule and practice model.

Establish multiple income streams through job stacking and strategic business opportunities.

Why This Model Works for Physicians

🔹 Tax Efficiency

Reduce your tax burden and increase your take-home pay.

🔹 Professional Autonomy

Control your schedule and how you’re paid.

🔹 Income Diversification

Build multiple income streams while maintaining W-2 stability.

🔹 Long-Term Wealth Accumulation

Retain more of your earnings through strategic financial structuring.

🔹 Better Work-Life Balance

Greater control over your time and career choices.

The smartest doctors aren’t just working harder—they’re working smarter.

Get Expert Guidance Now And Get StartedWho This Is For (and Who It’s Not For)

✅ Employed Physicians – Looking for greater financial flexibility and control.

✅ High-Income Physicians – Seeking to reduce taxes and retain more earnings.

✅ Doctors Interested in Business Structuring – Want to leverage business models for higher income.

✅ Physicians Focused on Financial Independence – Want to build long-term financial security through smart financial planning.

❌ Physicians who are satisfied with traditional employment and high taxes.

❌ Doctors who are not interested in maximizing income through business structuring.

❌ Physicians who are not ready to invest in their long-term financial success.

Why Choose PEA for Employment Lite?

Expert Guidance from Dr. Tod Stillson

Dr. Stillson has over 30 years of experience guiding physicians through business structuring and financial optimization. He has helped thousands of doctors escape the financial pitfalls of traditional employment.

Dr. Stillson successfully transitioned from traditional employment to employment lite over a decade ago. That transformational experience has inspired the creation of PEA-SimpliMD where he helps fellow physicians find the freedom that he discovered through journey to independent practice.

Part of the PEA Ecosystem

The Employment Lite Program is part of the larger Physician Entrepreneur Academy (PEA) framework:

Access to a Trusted Professional Network

🔹 Accounting & Tax Advisors

Trusted PEA partners who provide accounting services for independent physicians using a proven playbook that leads to success.

🔹 Wealth Management

Premium financial services with PEA partners who structure wealth accumulation strategies and protect physician assets.

🔹 Legal Network Expertise

Exclusive access to PEA's private network of legal professionals for contract negotiation, business formation, and legal structuring.

Success Stories

“Employment Lite was a game-changer! I doubled my tax-advantaged retirement savings and cut my tax bill significantly.”

– Dr. Michael T.

“I kept my W-2 job but finally feel in control of my career. Every employed doctor needs to read this!”

– Dr. Sarah B.

“This is the future of physician employment. I wish I had learned about it sooner!”

– Dr. Jonathan L.

Frequently Asked Questions

Why is the initial fee so high?

What if my employer doesn’t agree?

How quickly can I start benefiting from this model?

Take Control of Your Career with Employment Lite

Stop overpaying in taxes and start building wealth through smart business structuring. Take advantage of a hybrid career model that increases income and professional freedom. Only a limited number of onboarding spots are available each quarter—secure yours today!

Book a Private Consultation & Start Your Employment Lite Journey Today