Solo 401(k) ContSolo 401(k) Contribution Limits If You Job Stack With A W-2 Job

May 01, 2025

If you're a physician who is strategically job stacking by combining a W-2 position with 1099 income, you have a unique and powerful opportunity to maximize your tax-advantaged retirement savings. This dual-income approach not only enhances your earning potential but also opens the door to optimizing your financial future through strategic retirement planning.

However, the complexity of managing 1099 micro-business Solo 401(k) contribution limits in conjunction with an existing workplace W-2 401(k) or 403(b) plan can be daunting. Understanding how these elements work together is crucial for making informed decisions that will benefit you in the long term.

Let's break it down into simple terms and clearly illustrate how you can take full advantage of these savings opportunities. By leveraging both types of income sources, you can potentially increase your overall contribution limits significantly. With careful planning and execution, you could enjoy substantial tax benefits now while setting yourself up for a more secure and comfortable retirement later on.

Understanding the Contribution Limits

When you find yourself juggling both a W-2 job and additional 1099 income, understanding the nuances of contributing to a Solo 401(k) becomes crucial.

The key factor that influences your contribution ability is how your employer's retirement plan is configured. If your W-2 employment offers a 401(k) plan, it may limit or impact the extent to which you can contribute to a separate Solo 401(k). This is because contribution limits are aggregated across all plans in which you participate.

However, if structured wisely, having both types of income streams can offer unique opportunities for maximizing retirement savings and tax advantages. It's essential to explore how these plans interact and consult financial advisors who can help navigate complex IRS regulations, ensuring that you take full advantage of what these retirement options have to offer while maintaining compliance with tax laws.Here are the key takeaways:

-

One Employee Contribution Limit Across All 401(k)s

-

In 2025, the maximum employee contribution (pre-tax or Roth) is $23,500 if you’re under 50.

-

This limit is shared across all 401(k) and 403(b) plans, meaning if you max out your W-2 job’s 401(k), you can’t make another employee contribution to your Solo 401(k).

-

-

Separate Employer Contribution Limits for Each 401(k)

-

If your 1099 income is from a separate, unrelated employer (which includes yourself as a micro-business owner), you can contribute additional funds through employer contributions.

-

The 2025 total contribution limit (employee + employer) per 401(k) is $70,000.

-

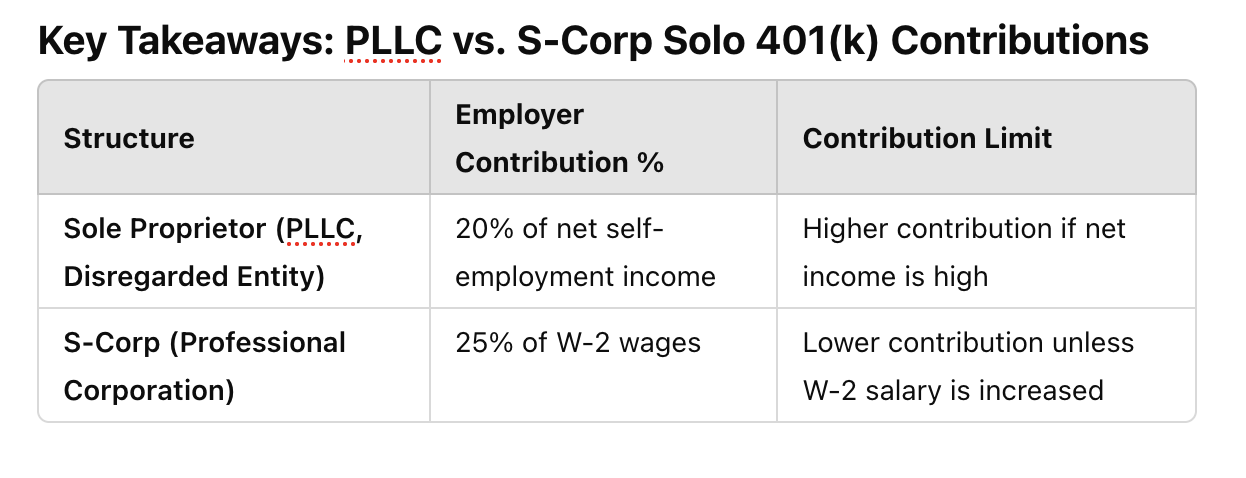

Employer contributions are limited to 20% of net self-employment income (or 25% of W-2 salary if you pay yourself via an S-corp).

-

-

Special Rule for 403(b) Plans

-

If your W-2 employer offers a 403(b), it shares the $70,000 limit with your Solo 401(k), potentially reducing your available contributions.

-

So now let’s take this knowledge and information and apply to some real life situations. I will present two the most common business entity structures that doctors will use for 1099 income:

-

A disregarded entity like sole proprietorship or single member PLLC

-

A professional corporation such as a Professional Corporation (PC) or PLLC taxed as an S-Corp.

Case Studies: How Business Structure Impacts Solo 401(k) Contributions

Case Study 1: Single-Member PLLC (Disregarded Entity)

Meet Dr. Patel: Dr. Patel earns $400,000 in W-2 income from a hospital-employed job and an additional $200,000 as a 1099 contractor through locums work. He operates his independent work as a single-member PLLC taxed as a disregarded entity.

Retirement Contribution Strategy:

-

W-2 Employer’s 401(k) Contribution:

-

Employee Deferral: $23,500 (Maxed Out)

-

Employer Match: $16,500 (Hospital contributes 4.125% of salary)

-

Total Contributions: $40,000

-

-

Solo 401(k) Contributions from 1099 Income:

-

Since the employee deferral limit is already maxed, Dr. Patel can only make employer contributions.

-

Employer Contribution: 20% of $200,000 net self-employment income = $40,000

-

Total Contributions to Solo 401(k): $40,000

-

Case Study 2: Single-Member Professional Corporation (S-Corp)

Meet Dr. Lee: Dr. Lee also earns $400,000 in W-2 income and $200,000 in 1099 income, but she operates her 1099 work through a single-member Professional Corporation (P.C.) taxed as an S-corp. She pays herself a W-2 salary of $100,000 and takes the remaining profits as distributions.

Retirement Contribution Strategy:

-

W-2 Employer’s 401(k) Contribution:

-

Employee Deferral: $23,500 (Maxed Out)

-

Employer Match: $16,500 (Hospital contributes 4.125% of salary)

-

Total Contributions: $40,000

-

-

Solo 401(k) Contributions from S-Corp Income:

-

Since the employee deferral is already maxed, Dr. Lee can only make employer contributions.

-

Employer Contribution: 25% of her S-Corp W-2 salary ($100,000) = $25,000

-

Total Contributions to Solo 401(k): $25,000

-

When evaluating the optimal structure to maximize your solo 401(k) contributions, it's crucial to grasp how your selected business entity and tax classification can influence both your contribution limits and the strategies available to you.

Choosing between a sole proprietorship, a Professional Limited Liability Company (PLLC), or a Professional Corporation (PC), alongside deciding whether to classify it as a disregarded entity or an S-Corporation, can have profound implications on your retirement planning.

Each configuration offers distinct advantages and potential drawbacks that could affect how much you are able to contribute annually. For instance, opting for an S-Corp may allow you to allocate more funds toward employer contributions due to its unique tax advantages, potentially helping you reach higher contribution thresholds. Conversely, opting for sole proprietorship might simplify administrative tasks but could limit certain strategic options available with other structures. Therefore, understanding these nuances is not just beneficial—it is imperative for ensuring that you are effectively leveraging all possible avenues to bolster your retirement savings plan.

For example, if you are structured as an S-Corporation, the employer contribution limit is set at 25% of your W-2 wages. However, this arrangement often results in lower overall contributions unless you strategically increase your W-2 salary. By boosting this salary component within reasonable IRS guidelines, you can potentially elevate the contribution amount possible for an S-Corporation setup.

For these reasons, we advise seeking the expertise of a CPA or Attorney who is well-versed in business entities and taxes to provide you with professional advice and guidance. Fortunately, we have curated a network of pre-vetted professionals specifically for our SimpliMD community members, ensuring an easy connection to qualified experts. Let me save you time and money by engaging with SimpliMD as your guide to help you build your business team.

Take Action: Optimize Your Tax Strategy

If you’re job stacking, you’re leaving money on the table if you’re not optimizing your retirement contributions. With a personalized micro-business consult, we help you:

✅ Navigate Solo 401(k) vs. SEP IRA options

✅ Structure your 1099 income for maximum tax efficiency

✅ Identify advanced retirement savings options like cash balance plans

For only $99, you get a one-year SimpliMD membership (valued at $2,500 in business resources) and a step-by-step roadmap for your independent practice.

👉 Book Your Personalized Micro-Business Consult Today

Start Your Micro-Corporation and Unlock Bigger Tax Savings

Beyond retirement savings, a micro-corporation allows you to access:

🔹 Tax deductions for health insurance, home office expenses, and CME

🔹 Legal protection from malpractice risk

🔹 Higher income potential through direct contracting

With SimpliMD Business Guide Services, we connect you with vetted legal and accounting experts who specialize in physician tax optimization—saving you time and thousands in unnecessary fees.

For just $500, we’ll build your business foundation right from day one.

👉 Get Your Professional Business Team Guide Today

💬 Lessons from the Field

"I had no idea my side hustle could unlock an extra $40,000 in tax-deferred retirement savings—until we ran the numbers together." – Dr. M., Hospitalist & Telehealth Consultant

Mini Story:

Dr. M. is a full-time hospitalist earning W-2 income, but she also moonlights as a telehealth consultant, bringing in around $120,000 annually as a 1099 independent contractor. She had been reporting her income correctly, paying her quarterly taxes, and assumed she was doing everything right—until we sat down for a micro-business consultation.

In just one hour, we uncovered that because she was operating as a sole proprietor and had already maxed out her W-2 employee 401(k) contributions, she still had the opportunity to contribute up to $24,000 in employer contributions to a Solo 401(k) from her 1099 income.

She was shocked—and a little frustrated—realizing she’d missed out on this strategy for the past three years. But now, with a Solo 401(k) in place, she's not only shielding more income from taxes but also fast-tracking her long-term savings goals.

This is exactly why I say: your micro-business isn’t just extra income—it’s a financial engine, if you structure it right.

📥 Tool of the Week

Solo 401(k) annual contribution calculator.

Use this interactive Solo 401(k) Annual Contribution Calculator from MySolo401k.net. It breaks down IRS-compliant limits in detail and gives you additional precision for complex cases."

🧠 Pro Tip: Pair this tool with your free copy of the PEA Micro-Business Vault: 10 Hidden Revenue Streams for Physician Entrepreneurs to generate more 1099 income—and unlock even greater Solo 401(k) contribution potential.

🚀 Scale with Coaching

Want personal guidance? Our 1:1 coaching and consultations help you execute faster and smarter.

If you're job stacking and feeling unsure about how to structure your 1099 income for optimal Solo 401(k) contributions—or if you're just tired of Googling your way through retirement and tax planning—let us help.

With PEA-SimpliMD coaching, you get personalized, physician-specific business strategy to help you:

✅ Maximize retirement contributions (Solo 401(k), SEP IRA, cash balance plans) ✅ Choose the right entity structure (PLLC, S-Corp, Sole Prop) ✅ Reduce tax liability and unlock new revenue streams ✅ Build your micro-business with confidence and clarity

👉 Book a Strategy Consultation Session for $99 — includes 1-year Explorer Membership + downloadable tools, resources, and an expert roadmap.

🧑💼 Ready to go deeper? Get Started With 1:1 Business Coaching today and accelerate your growth with hands-on guidance, custom plans, and ongoing support from a coach who understands both medicine and business.

Final Thoughts

If you’re job stacking as a W-2 and 1099 physician, you need a clear retirement savings strategy to maximize your contributions while minimizing taxes. The Solo 401(k) offers one of the best tax-deferred options, but it must be structured properly.

Don’t leave money on the table. Start today by optimizing your micro-business with PEA-SimpliMD!

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.